osceola county property tax calculator

Welcome to the Osceola County Treasurers Web page. Delinquent taxes may be paid online or in person with personal check cash or money order up to the delinquent tax certificate sale.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Osceola County.

. Present this offer when you apply for a mortgage. Osceola TV County Meetings. 8am - 5pm Monday through Friday excluding holidays if you are making a payment you must receive a wait number by 430pm The Recording Department stops recording promptly at 430PM.

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. Osceola County Property Appraiser Attn. Florida voters overwhelmingly approved a constitutional amendment Amendment 1 on January 29 2008 which grants added tax relief to property owners.

We use a Market Value range of 875 to 1125 of the purchase price you enter. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

St Cloud FL 34769. Osceola County Florida Mortgage Calculator. 4730 South Orange Blossom Trail.

Ad Find Osceola County Property Tax Info For Any Address. Online Property Taxes Information At Your Fingertips. 407-742-3500 Send Feedback Hours.

We are committed to providing the best possible service to Osceola Countys residents. Osceola County Florida Property Search. If you have questions you can reach us at.

Actual property tax assessments depend on a number of variables. Choose RK Mortgage Group for your new mortgage. The information provided above regarding approximate insurance approximate taxes and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only.

Automate state and local taxes on rental properites so you can focus on guest experience. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Under Florida law e-mail addresses are public records. 407 742-5000 to arrange for a visit from our office to assist you with any exemption for which you are applying.

If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. FIND US AT ONE THE FOLLOWING LOCATIONS. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Learn all about Osceola County real estate tax. Tangible Department 2505 E Irlo Bronson Memorial Highway Kissimmee FL 34744. Real estate taxes become delinquent each year on April 1st.

After the tax certificate sale taxes must be paid by cashiers check certified check cash money order wire or credit card. Property Tax Collection Issuance of Vehicle Titles and Registrations and Driver License Issuance. Osceola County Courthouse 2 Courthouse Square Kissimmee Florida 34741 Contact Information.

The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. We Provide the following services from our office. The in-person meeting will be conducted as an open house from 530-730 pm.

Property taxes in Brevard County are somewhat lower than state and national averages. Therefore the countys average effective property tax rate is 086. The countys average effective property tax rate comes in at 086.

1300 9th Street Suite 101B. For more information go to the Tax RollMillages link on the homepage. The median property tax on a 19920000 house is 209160 in the United States.

Osceola County will hold a public meeting regarding proposed improvements to Old Lake Wilson Road from County Road 532 to Sinclair Road on Tuesday February 22 2022.

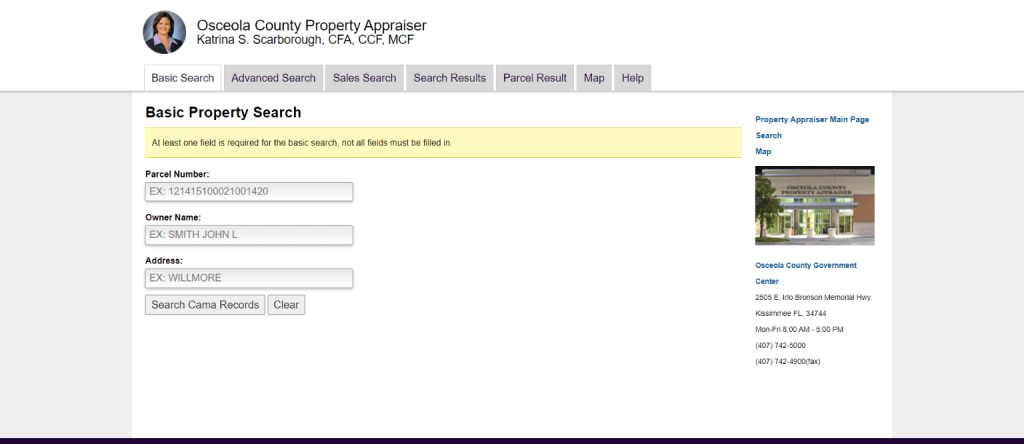

Osceola County Property Appraiser How To Check Your Property S Value

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

2013 2016 Technology Plan Osceola County School District

Osceola County Property Appraiser How To Check Your Property S Value

Florida Income Tax Calculator Smartasset

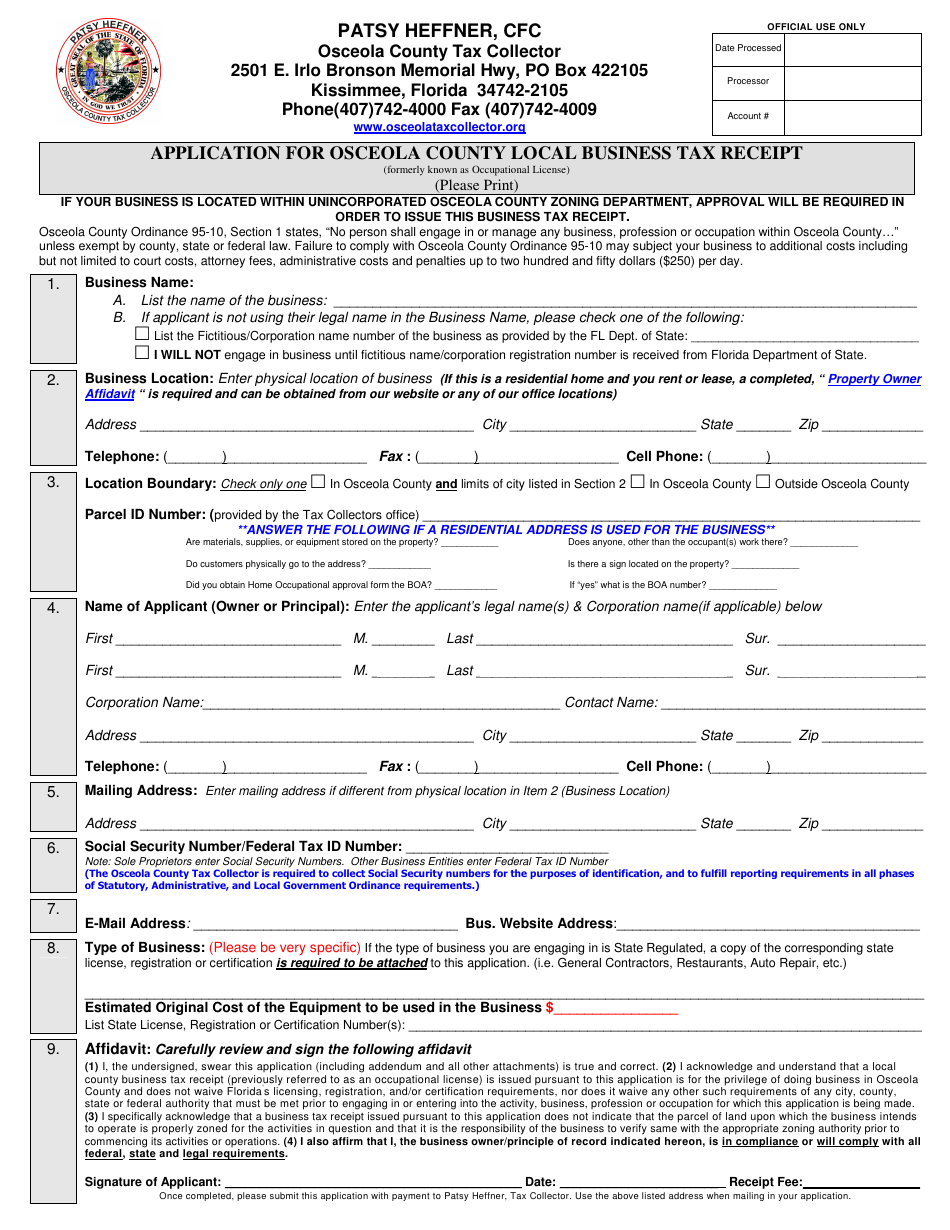

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Property Appraiser How To Check Your Property S Value

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller